Why isn't the stock market down more?

S&P500 continues to be the Rasputin of all stock markets.We're less than 3% off all-time highs yet it feels like the market is teetering on the brink of disaster.

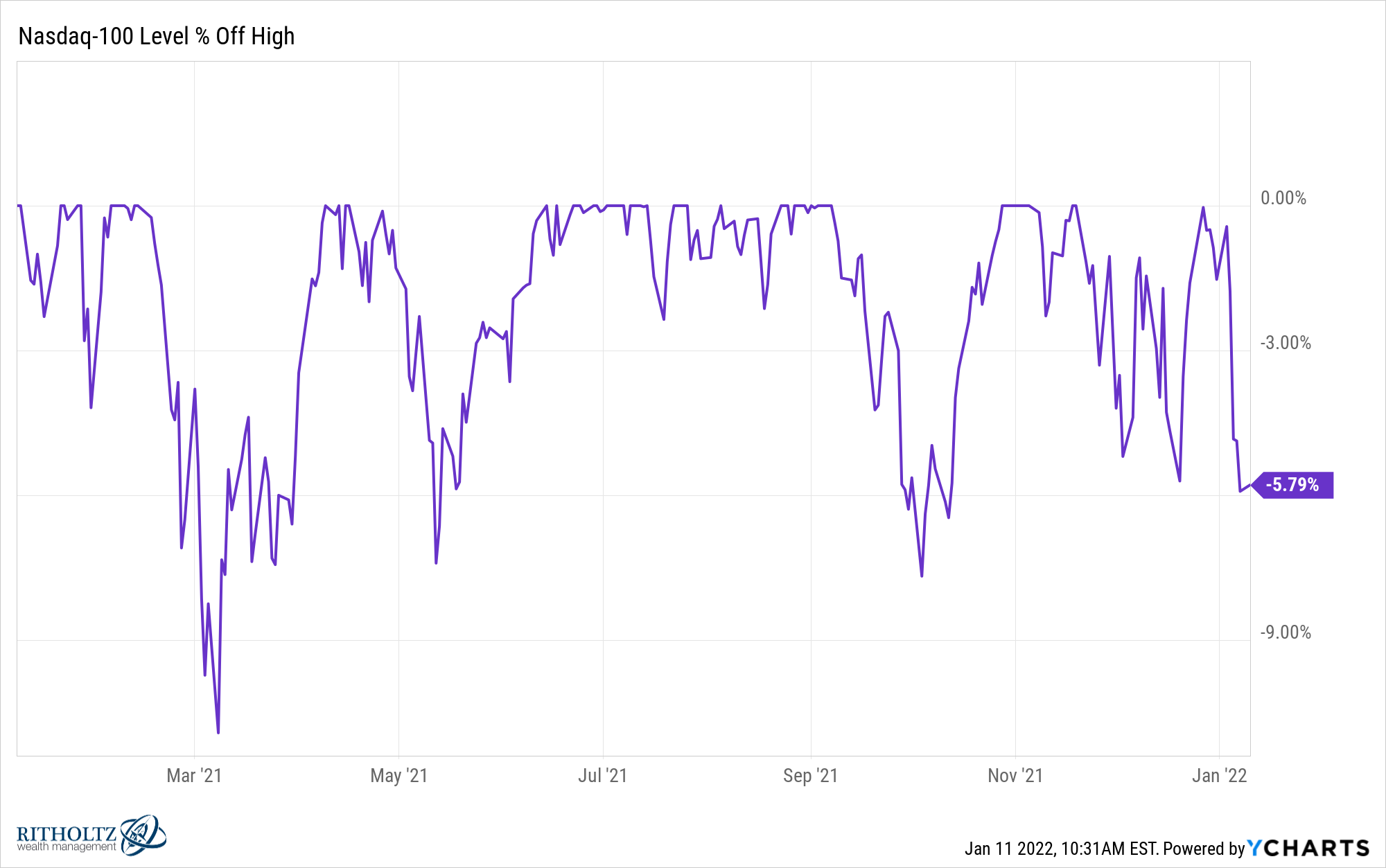

The Nasdaq 100 is down around 6% from its highs so big tech stocks are still holding up as well.

Small cap stocks are in the midst of a correction as the Russell 2000 is now down more than 11%.

This makes sense when you realize small caps are consistently more volatile than large caps. Over the past 10 years, the Russell 2000 has experienced six separate double-digit corrections, including three fairly brutal bear markets.

During this same time the S&P500 has experienced four corrections including a single bear market.

So far things don't look so bad.

Then you have companies like Robinhood, Zillow and Peloton that are more than 70% off their highs.

There are at least 100 stocks in the S&P500 down 20% or more from their 52-week highs.